China: Powerful economy

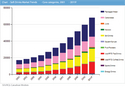

4 May 2012The growing beverage market in China offers packaging suppliers huge opportunities. Here we summarise some of the key packaging trends in China as found in the latest country report from Canadean, the global market research consultancy

A price-hike in packaging materials is now putting pressure on the growing beverages industry in China.

PET, which holds the lion’s share of the packaging mix continued to take share from other pack types in 2010. This was because packaged water, iced/rtd tea drinks and still drinks, which predominantly use PET, grew above the market average.

As the price for PET resins increased during 2010, soft drink producers attempted to cut costs by using lighter or smaller-sized PET bottles. However, a bottle weighing under 10g introduced a couple of years ago for packaged water was not very successful, as the bottle was found to be too thin to hold easily.

Single-serve PET sizes gained share as producers are hesitant about promoting large sizes which offer a lower profit return.

Cartons, from only a small base in 2010, enjoyed a significant presence in only juice, nectars and still drinks. As cereal drinks, which are mainly packaged in carton, are now included in the still drinks category, this has helped to bring up carton’s share of the soft drinks packaging mix. The rapid development of cereal drinks helped to improve the performance of cartons in 2010 in volume terms, although its share did not grow significantly.

The implementation of an antitrust law has released producers from having to be tied into long-term contracts with the major carton specialists. This has enabled more carton suppliers to enter the market and helped to reduce the cost of producing carton packaging. This will in turn help the expansion of carton usage in the beverages industry.

Cans are mainly popular as the pack choice for nut and herbal drinks as well as the traditional carbonates. However, with the stagnation of herbal drinks in 2010 its share dropped, although volume grew, albeit slowly.

In 2010, a leading manufacturer changed all of its 3-piece cans to 2-piece, as the latter involves lower production costs.

The cost of raw materials for packaging increased dramatically in 2010, having a negative impact on margins of beverage manufacturers. Consequently producers are assessing the entire packaging process, including blowing and filling, to see where costs can be saved. Some have tried to cut the cost of packaging materials by using thinner PET bottles or shifting to cheaper cartons from local suppliers.

Beer market

The glass bottle remains dominant, however pack sizes are becoming smaller and more pack types are appearing. Some brewers have downsized their glass bottles while maintaining the same retail price to improve margins.

However, its share is decreasing as the industry encourages brewers to develop more pack styles and smaller sizes, which can help reduce energy usage and costs.

As a result, more pack sizes are appearing in the market; medium sizes 50cl, 52.8cl and 58cl are rapidly increasing.

In recent years, environmental concerns, cost-saving initiatives, convenience issues and novelty elements have driven packaging innovation. This is bringing PET, aluminium and mini-keg formats under the spotlight. PET has made its appearance in large cities such as Shanghai, Guangzhou and Beijing, but the volume remains very small. Rapid development is not expected in the near future due to higher prices and the initial investment costs involved. Consumers also see the glass bottle as more environmentally friendly than PET.

The aluminium can pack continues to grow with the rapid development of modern retail outlets in China.

Multi-packs are popular in modern channels and their share is increasing owing to the popularity of shopping in supermarkets and convenience stores. Due to the increasing pressure on costs, traditional 35.5cl cans have been replaced with 33cl cans by some brewers.

Bottled water

PET maintained its leading position with its market share increasing slightly. As the gross margin is still comparatively thin in this category, manufacturers focused on packaging innovation in order to control costs. In April 2010, a major producer released a new lightweight PET bottle for its packaged water brand. The new bottle weighed 35% lighter than the original, and is expected to help the company save on raw material costs.

In terms of sizes, 35cl and 55cl packs performed well in 2010, while the 60cl and 125cl sizes lost share.

As consumer concerns about healthy drinks gradually increase, manufacturers have been keen to acquire natural good quality water sources, which can help to improve their brand image.

Glass bottles remained niche in terms of volume, mainly used by imported and local premium brands such as Perrier (Nestlé) and Laoshan (Qingdao Beverage Group).

Polycarbonate bubble top is the standard pack type for bulk/HOD water. 1,890cl maintained its position as the predominant pack size. The share of a smaller pack size edged forward thanks to increasing demand from small families.

Plastics pouch packaged water appeared in 2006. However, volume is now negligible, due to its relatively higher price and the lack of significant big players using this pack type.

Carbonates

PET is the key pack type and increased share in 2010, while glass bottles and cans continued to forfeit share as volume declined. Family-size PET bottles took the volume and share from samller sizes as they are perceived as offering better value for money.

Carbonate share of soft drinks dropped again in 2010. As consumer health awareness increases the trend is growing towards other non-carbonated RTD drinks with a healthy image.

The can market continued to drop as consumers chose PET for its convenience. Cans were also hampered in 2010 by the replacement of the 35.5cl can with smaller pack sizes by the leading carbonate beverages players.

Glass bottles remained niche and did not show any sign of recovery in 2010. In north and north-west China carbonates brands packaged in glass bottles are mainly popular in the summer and during hot weather when consumers buy more chilled carbonates in glass bottles from kiosks for immediate consumption.

Juices

PET increased its share in 2010 as most producers involved primarily use PET packaging. Newcomer COFCO has further driven this trend with a single-serve pack.

With the success of Huiyuan’s family-sized pack, more producers such as Lotte Huabang also launched products in this size to target family consumption. The 200cl size also gained more share of throat for home consumption as it offers value for money for ordinary families.

Cartons, the second leading pack type, only made modest gains in volume terms. As most producers have PET filling lines, cartons are mainly used by those producers who have already installed carton filling equipment.

Huiyuan remained the biggest carton user. More single-serve sizes, such as the 20cl carton, appeared on the market in 2010 targeting impulse consumption.

Glass bottles picked up more volume sales, if not share, in 2010 as some local producers launched products packed in glass bottles targeting the Horeca sector.

The use of cans is very small in this category but volume increased in 2010 when producers such as COFCO and Uni-President launched tomato juice in cans.

Nectars

PET is also the predominant pack type for nectars and it continued to take market share in 2010, driven primarily by family-sized packs from both leading players and local producers.

Large family-sized packs with the advantage of giving consumers value-for-money are more attractive for home consumption and festival sales.

Single-serve sizes did not perform as previously because the big brands could not capture impulse consumption, as nectars are not usually seen as a thirst-quenching beverage.

Cartons also managed growth but at a slower pace. Only big producers such as Huiyuan and a few other local players offer nectars in cartons.

Glass bottles achieved a higher volume of sales than in recent years as there are more local producers entering this category with products packed in glass bottles, primarily sold in Horeca or modern outlets at higher prices.

Still drinks

PET continued to increase its market share of the still drinks packaging mix as the growth of herbal drinks, which are largely packed in cans and cartons, has slowed down. Most single-serve PET bottles were impacted by the fading out of lemon C style drinks, but benefited from the fast growth of Minute Maid (Coca-Cola) and Tropicana (PepsiCo). Family size PET containers benefited from promotions by leading players as they tried to push volume sales.

Volume growth of cans slowed down as herbal drinks products, which primarily use cans, stagnated.

Cartons grabbed more sales in 2010 thanks to the strong growth of both nut and cereal drinks. Most cereal drinks are packaged in single-serve cartons and, therefore, their fast development has benefited carton packs.

In the squashes and syrups sector, glass started to take the majority share in 2010 as it is widespread in the retail sector.

PET lost significant share in 2010. All sizes decreased in volume apart from 200cl, which offers the best value for money.

Foil sachets are the predominant pack type for fruit powders. The individual single-serve sachet sold in a multipack innovated by Kraft in 2009 attracted younger consumers but did not grow as fast as expected, as it is more expensive than the bigger sizes.

Glass continued to lose market share, due to its greater costs associated with transportation.

PET was the leading pack type for iced/ready-to-drink teas with single-serve remaining the most popular. The 50cl size saw a spectacular growth of over 30% in 2010 boosted by marketing activities, like ‘get one bottle free’. These marketing campaigns resulted in significant sales growth for single-serve PET.

Cartons maintain a small market share, however they are losing out to PET bottles as the latter is more convenient for consumers and more suitable for both impulse and home consumption.

Cans remained niche, with some milk tea producers choosing it as a pack format.

A new pack format appeared in 2010. Attracted by the comparatively high gross profit margin, Want-Want, which had previously focused on dairy drinks, entered the iced/rtd tea drinks market with the introduction of a foil pouch primarily targeting children and younger women. The volume was comparatively small when launched.

For iced/rtd coffee drinks, the can remains the key pack type by taking a predominant share. However, its share was cannibalised by the PET bottle in 2010 as leading players have been gradually switching packaging types.

Sports and energy drinks

In the sports drinks sector, PET enjoyed considerable growth. Single-serve 50cl and 60cl packs were the main sizes used by key brands. 50cl PET in particular saw strong growth due to the performance of carbonated brands.

Can packaging saw spectacular growth in 2010, thanks to the recovery of key user Jianlibao.

Cans also maintained a leading position in the energy drinks sector. The volume of PET bottles used increased significantly Glass is usually used for premium products and volume remained small in 2010.

Domestic demand will be the momentum behind the economic development of China Domestic demand A range of bottled soft drinks displayed on a supermarket shelf in China Supermarket shelf Filing line in China Filing line PET, aluminium and mini-keg formats are finding increasing favour in the fast growing Chinese market Chinese market Soft drinks market trends Soft drinks