But the boom continues here

19 May 2009The speciality medical packaging sector is set for annual growth forecasts a recent survey. Ann Hirst-Smith reports

The European speciality medical packaging market is a diverse platform. It is also currently the focus of considerable growth, forecast to continue at 5 per cent annually to 2012 – an increase many other packaging markets wish they could match. That growth reflects a complex mix of materials, technologies, and distribution channels, and the overarching drive for single use medical disposable products.

The supply chain for speciality medical packaging must be the starting point for an understanding of the industry. Many of the suppliers are familiar names in the industry – the leading global suppliers of base papers, films, adhesives, inks and coatings. Converting the materials are two distinct converter streams: the principal converters, and the specialists.

The principal converters are often worldwide companies, creating web materials such as rollstock, specialist laminates, and high volume products such as pouches and bags. Their customers are the hospitals markets and the medical device manufacturers, both of which supply direct or via distributors.

Specialist converters, whose manufacturing set-up meets the stringent needs of the medical markets, use the web materials from the principal converters to make such items as thermoformed or moulded trays, bags, pouches, and lidding. Medical packaging converters are genuine specialists, with an in-depth knowledge of the extremely diverse, high end requirements of this market in terms of compliance with a variety of legal and safety regulations, and manufacturing techniques, often including cleanroom facilities. They supply packaging to both the device manufacturers and the hospitals.

The device manufacturers are at the heart of the speciality medical packaging market. They are responsible for many converted products – from original equipment through devices, tubing, dressings, and sutures to drapes, gowns, and gloves, sourcing components direct from either principal or specialist converters, or via distribution. Packaging their products may be part of their in-house capability, or they may move them through specialist contract packers.

The distributors may supply the packaging materials required or, indeed, finished packaged medical devices and procedure kits to the end use markets.

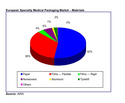

Most of the basic packaging supplied into the medical market comes in the form of flexible rollstock. Rollstock is prevalent in dressings and woundcare, where the development of devices requiring barrier properties to contain medication or advanced adhesive formulations is a major area for growth. Converters also use rollstock for a range of end use packaging formats.

Pouches and tubing together take 18 per cent of the medical packaging market, whilst the third major segment is the catch-all wrappings, bags, and miscellaneous category, in which wrappings take the greater share.

Syringes, needles, dressings and other wound care products, and catheters and stents, together consume the majority of speciality medical packaging in Europe. However, the packaging needs of orthopaedic implants and electro-mechanical devices are the fastest growing segments, at an estimated 7 per cent per year.

Orthopaedic implants can be heavy items, and sterility is essential, so pouches and rigid tray based blister packs are the chosen options. For delicate electro-mechanical devices, the need for contents protection is paramount. For pacemakers, double hard tray blister packs (PETG) sealed with Tyvek lids are used. Heart valves are packed in PP jars with Tyvek lids, with repair products in flexible APET trays with Tyvek lids.

As for materials, both governmental regulations and the commercial medical device manufacturing industry are looking at the current standard of medical papers – with particular reference to the dangers of loose fibres. Plastics are seen to be ‘cleaner’, and they are certainly stronger. Where paper bags might tear, a combination of HDPE and Tyvek provides a possible answer.

It is worth noting that the recently established standard ISO 11607, which specifies the requirements and test methods for materials, sterile barrier systems and packaging systems for terminally sterilised medical devices, is driving change in the industry‘s choice of materials, favouring non-wovens over medical grade papers.

At the same time, there is a focus in speciality medical packaging on developing thinner, lower cost materials without compromising quality and performance. ‘Leaner’ materials also contribute to the consideration of environmental responsibility.

Within plastics materials, the pharmaceutically approved PETG is being challenged today on cost grounds by APET, which is 20 per cent cheaper but so far lacks the performance characteristics. Additionally, medical device manufacturers who pack small runs of products in a specified medical grade PE are vulnerable in today’s financial climate, as suppliers stop production to create economies of scale in their businesses.

Paper manufacturers are adapting their products to the needs of the speciality medical market. One initiative involves simulating the properties of coated papers using uncoated grades, to offer both improved performance and cost advantages. Downgauging paper basis weights is another area where there is currently much activity.

There is also a move in some end uses to anti-microbial materials, using silver and other solutions, in the face of reported high levels of secondary infections.

Choice of material is also driven by the type of sterilisation to be used. Paper is permeable and thus well suited. while plastics need good aeration properties to ensure that no residues are left in the material. Other sterilisation methods, making different demands on material properties, are also gaining acceptance – including electron beam, gamma radiation, and plasma technology.

Manufacturers of medical devices are continuously innovating at all levels. Wound care is a good example. The basic product presentation, a simple proposition of cotton in paper packaging, plastics film sealed, is now being superseded where the new hydrocolloid adhesives are used. Containing silicones for painless removal of the dressing require more sophisticated packaging featuring moisture barrier properties.

New material suppliers or packaging converters entering the speciality medical market will need to give themselves time to do so. The device manufacturers are conservative, and do not easily change supplier; and the qualification process for a new source of supply, as well as a new material, can be lengthy.

Lower end devices and their packaging are now regularly sourced for European use from lower cost production areas. Medical device manufacturers cannot afford to take risks with packaging of ‘high tech’ devices destined to replace body parts, so this part of the market is still firmly in place in Europe.

There is also a high requirement to be able to view the contents of the pack, so traditional bags are losing market share.

For packaging orthopaedic devices, manufacturers are moving from blisters to pouches. But while they are looking for a 5-year shelf life, many pouch laminates offer only two years.

In commercial speciality medical packaging, there is considerable interest in blister packs – for the packaging of phials and syringes in particular.

Concentrating on advanced packaging, ‘difficult’ products, and demonstrably high production standards, including cleanroom packaging, are today’s most logical options for a converter interested in speciality medical packaging. These are high value, non-price sensitive markets which offer considerable opportunities.

This market is documented in a new study from AWA Alexander Watson Associates: European Speciality Packaging Market Outlook 2008: Market Overview and Opportunities for Medical Packaging Companies and Suppliers.

European Specialty Medical Packaging Market - Materials European Specialty Medical Packaging Market - Materials